tax sheltered annuity taxation

Low-Income Housing Tax Credit LIHTC property owners must include the cost of all Resident-paid utilities to a third-party utility provider based on Resident usage in the gross rent charged. The legislation Digital Products Bill ESHB 2075 enacted a retail sales tax on the purchase of digital products.

Qualified Vs Non Qualified Annuities Taxation And Distribution

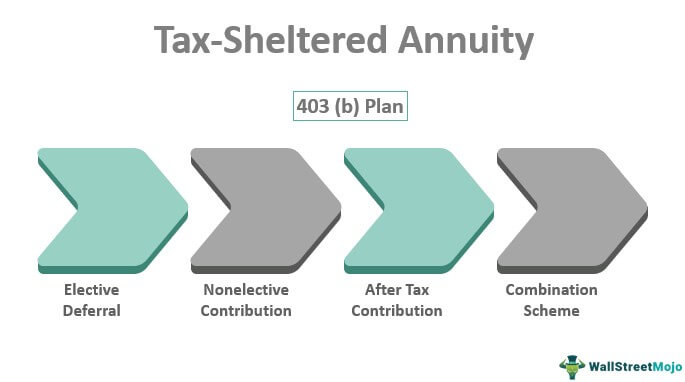

Its similar to a 401 k plan maintained by a for-profit entity.

. This new salesuse tax is effective as of July 26th 2009. The Tax Cuts and Jobs Act of 2017 provides a window of opportunity before 2026 to make use of your personal gift estate exemption of 11580000 2020-adjusted annually. A tax-sheltered annuity TSA plan is a retirement savings program authorized by section 403 b of the Internal Revenue Code for employees of educational institutions.

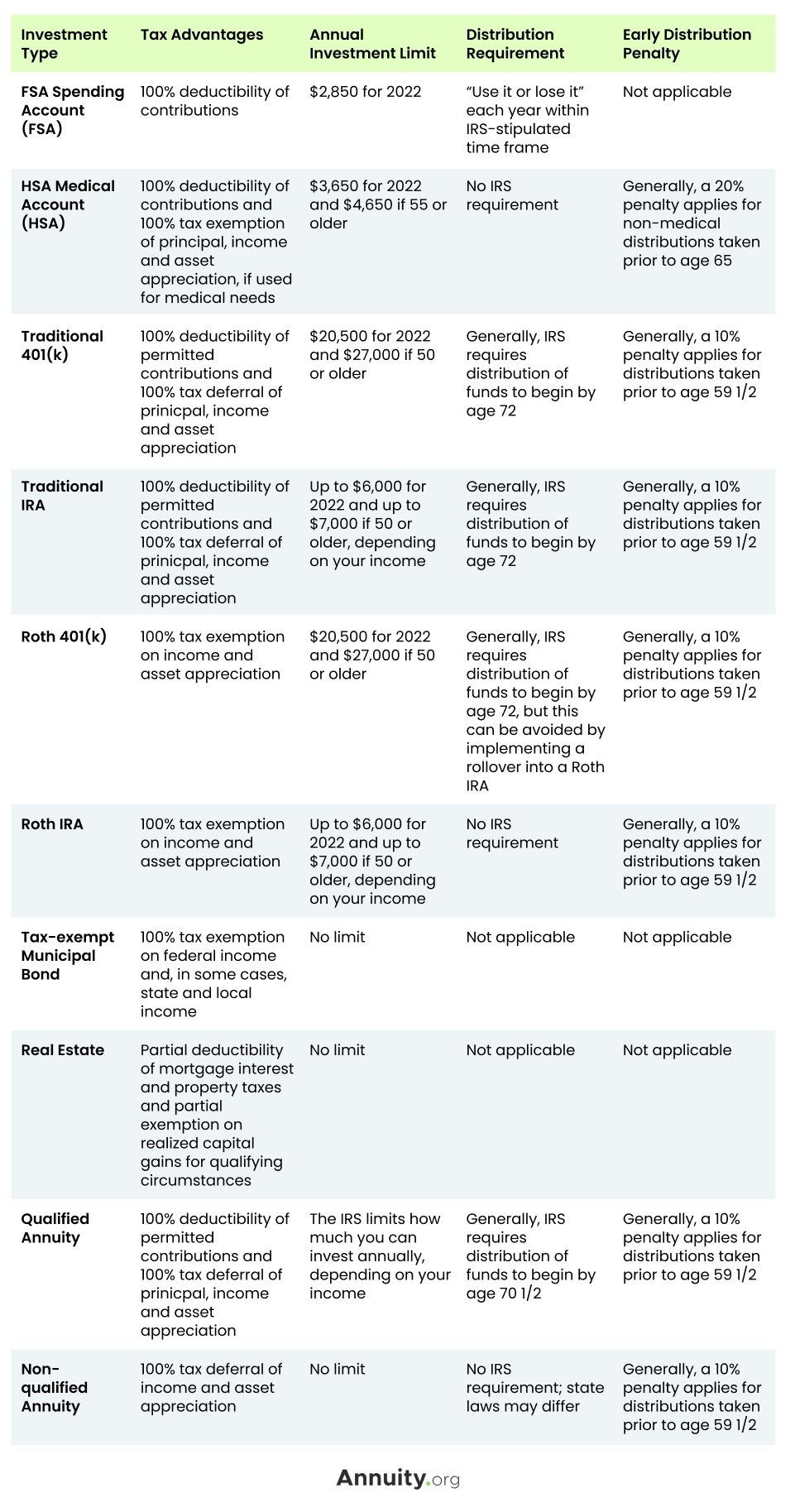

A tax-sheltered annuity allows employees to invest income before taxes into a retirement plan. People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. Ad Learn More about How Annuities Work from Fidelity.

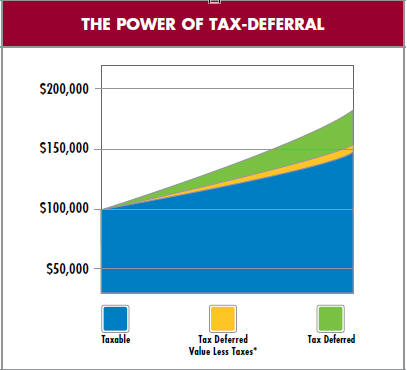

Tax-Sheltered Annuity TSA is a form of retirement savings plan in which the contributions made are from the income that has not been taxed and therefore the contributions and interest. Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Annuities are taxed at the time of withdrawal regardless of the.

The most significant benefit of a tax-sheltered annuity is that it reduces your taxable income. How taxes are paid on an. A non-qualified annuity is you purchased with money you have already paid taxes on.

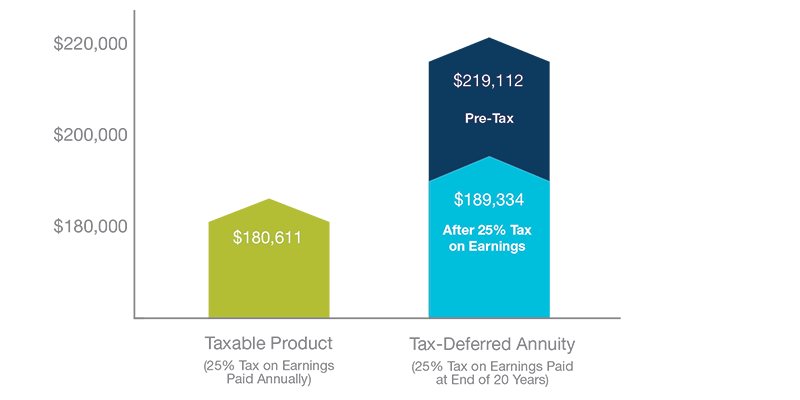

Great Northern Insured Annuity Corporation Jones Blouch LLP. Tax-deferred annuities allow taxpayers to reduce their taxable income by contributing pre-tax funds to an annuity premium. Learn some startling facts.

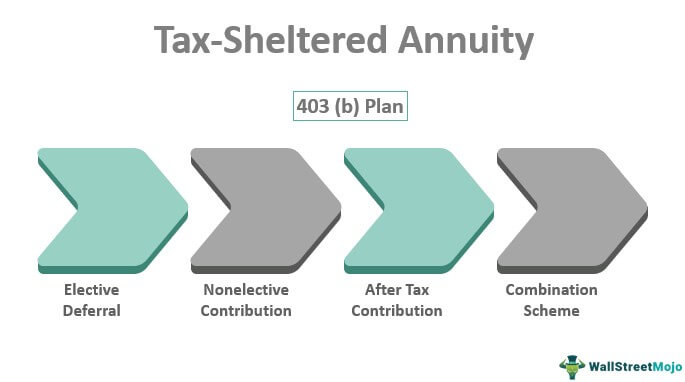

A 403 b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501 c 3 tax-exempt. Ad Learn More about How Annuities Work from Fidelity. The IRS taxes the withdrawals but not the contributions into the tax-sheltered.

A tax-sheltered annuity plan gives employees. The contributions made to a non-qualified annuity arent taxable. Of course this is assuming you have a pre-tax annuity.

Ad Annuities are often complex retirement investment products. However any growth or earnings on your initial. So if you wrote a check from your taxable bank or brokerage account to pay the premium.

As a refresher an IRS-approved tax-sheltered annuity also known as a TSA or 403b is a retirement plan offered by public schools and some nonprofit organizations with. A 403 b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities. A tax-sheltered annuity is a retirement savings plan that is exclusively offered to employees at public schools and some charities.

That kind of sounds like a Roth account but theres a catch. Two Union Square Suite 5600 1025 Thomas Jefferson Street NW Seattle Washington 98111-0490 Suite 405 West 206-625. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal Revenue Code.

Tax Sheltered Annuity Faqs Employee Benefits

Annuity Taxation How Various Annuities Are Taxed

Learn About Retirement Income And Annuity Tax H R Block

What Are Tax Sheltered Investments Types Risks Benefits

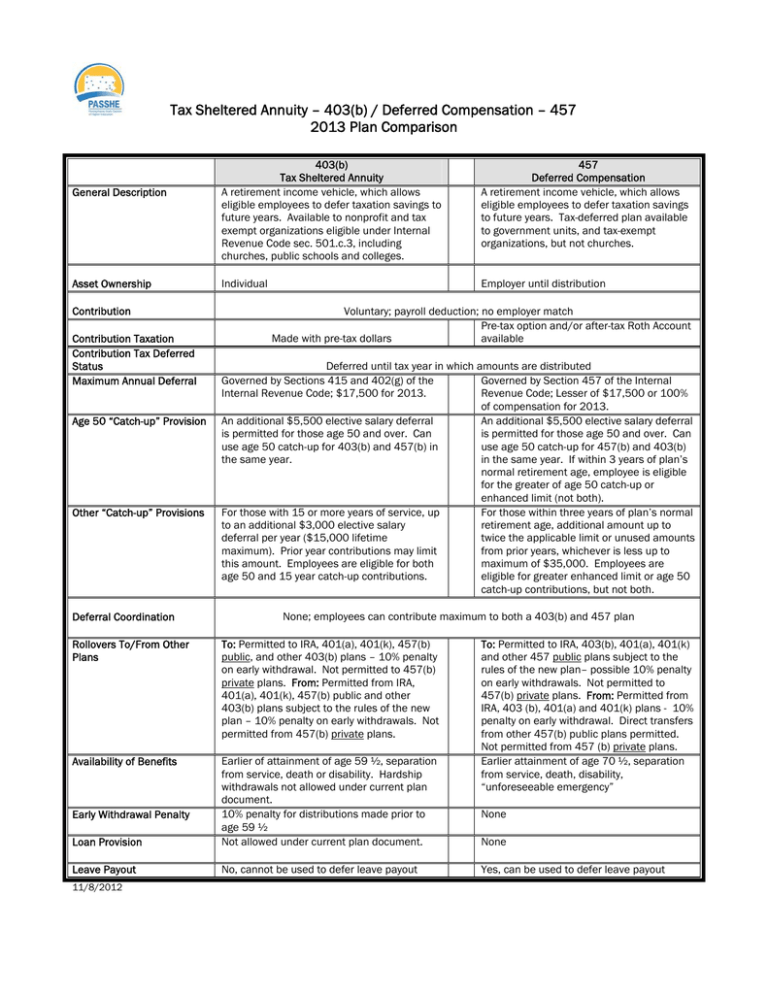

Tax Sheltered Annuity 403 B Deferred Compensation 457

A Tax Deferred Annuity 101 Guide For Non Biased Consumers Due

What S The Difference Between Qualified And Non Qualified Annuities

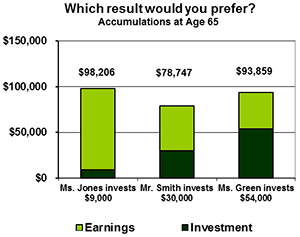

What Is The Benefit Of Tax Deferred Growth Great American Insurance

Annuity Taxation How Various Annuities Are Taxed

Withdrawing Money From An Annuity How To Avoid Penalties

How To Avoid Paying Taxes On Annuities Due

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

Annuity Lifetime Income Later Safety Taxes Magi

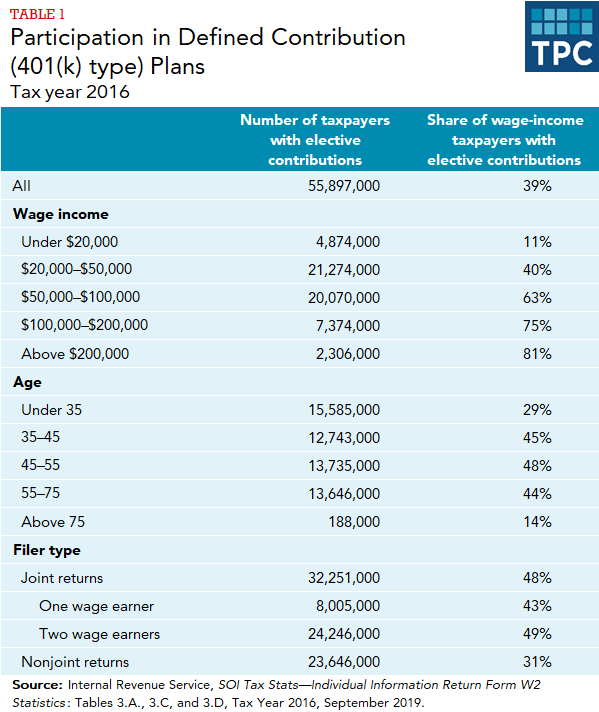

What Are Defined Contribution Retirement Plans Tax Policy Center